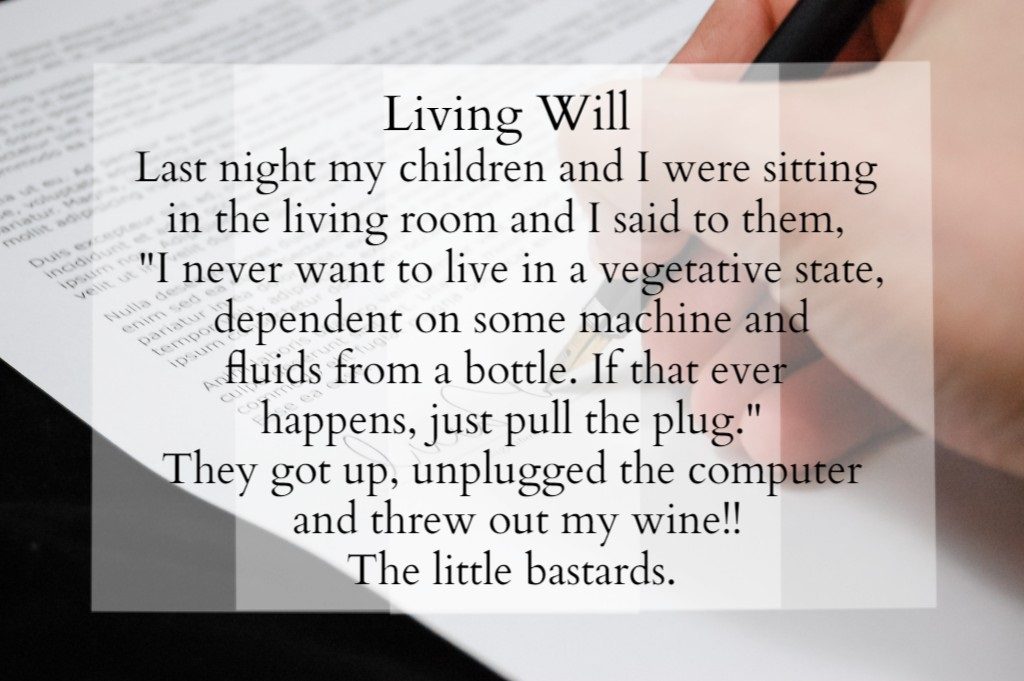

Everyone older than 18 should have a trust. Aretha Franklin, what a voice…but she died, sadly, intestate, a fancy word for no will or trust. When this happens, the state is forced to make decisions for you. And, as the sample Living Will (below) proves, we don’t always understand what these legal terms mean.

There is no doubt in this real estate dad of 11’s mind, it is important. You don’t want arbitrary bureaucrats, even if they might mean well, trying to read your mind beyond this world.

For example, ‘My Living Will’ shows creative ideas & strict interpretation of the law and familial needs, but I don’t think the little B’s really were born outside of wedlock. They just interpreted mom’s comments literally but differently than she meant.

Put simply, if you don’t take care of your affairs, property and intentions, your “will”, guess what: the state happily will.

Your desires and intentions must be written; This is where a living trust comes in. Take the verbal “Living Will” pictured above; it’s more than a little humor. Her wishes were real but misinterpreted. With legal advice, she’d better understand HIPPA and other issues.

A trust is a contract to specify your wishes for your assets andyour heirs. Life Insurance IS a kind of trust between you (trustor), your insurance company (trustee), and your beneficiaries, where the beneficiaries are paid without probate, since your wishes are legally specified. Often the insurance policies are included in the trust listing of assets for convenience, but it is a contract that stands on its own as well.

Mom expressed her health wishes regarding the vegetative state that can happen; the kids took swift action to separate mom from wine and facebook. So, if your will is not “contractually” housed inside a trust, as well as your bank accounts and real property, etc., a judge, who works hard to do it right, will decide usually with the aid of a good or not so good estate/trust attorney, a.k.a. probate. The judge works hard to do it right,

In simple terms, probate is the state deciding for you; a trust is you deciding for you. The “little bastards” sired by Mr. and Mrs. B demonstrated a miniature probate by deciding her future based on imperfect interpretation of her audibles, her spoken will. A trust is a contract with specific beneficiaries; probate is a dart board with people outside the family making decisions for you. Of course, the state is not soulless, and there are rules of succession when it comes to probate. Who will be appointed to personally represent you (legal term is personal representative), however, could be a turkey shoot; next in line just may be Scofflaw, Jr. who frequents the casinos more than a Vegas janitor at the Golden Horseshoe.

If you have lots of kids, you can do trusts within a trust to guide future events; use wisdom not expediency.

I have been doing real estate since ’88, and part of my practice has been at the courthouse selling properties for court appointed receivers, judges and trust attorneys.

Example: partition hearings where owners disagree about selling, such as the property from three siblings, brother & sisters that co-owned but memories of who did what have oddly changed. Or a large $100 million MediCal fraud case with 77 victims and property needing to be sold to satisfy restitution required by the excellent judge. Among others. The tragic and the triumph stories side by side all indicate you must make your wishes known.

Sure, you can go online to get forms, but that online form won’t represent your heirs or you in court when a major defect in the legal is discovered. Or it lacks sufficiency in really recording your wishes. And, you don’t need to own $10.98 million in GROSS wealth for this to be important; smaller “estates” need protection because probate fees are legislated and not cheap.

Recall Aretha Franklin’s four sons now must battle it out, since there was no trust. Not even a will. But, no, the probate judge must decide on the best information available. Her life work is up for years of court battles, unless the judge assigns an honorable person. Rumor has it, her longtime attorney often recommended a trust but she never did it. News flash: ALL of us will die someday and there aren’t UHaul trailer hitches on hearses.

Best way is to hire a good estate/trust attorney to do it right. It’ll cost you more than a $2 independence bill but not a million. My conclusion is a simple one: get with a good trust/estate attorney for a living trust; codify your wishes for your offspring and what you have acquired should be your own. Concerned you will resemble the Matrix, held together by wires and tubes? Then you need a knowledgeable honest trust atty who understands medical laws AND your wishes regarding DNR (do not resuscitate) or other medical needs. BOTH are important. Otherwise, probate and/or conservatorship (if you CAN’T physically make your own decisions) could result.

If you don’t put your wishes in writing with a good trust attorney (we can give you the names of some): then you don’t control much of anything.

People, start your engines and get your trust going.

Len Beckman

Broker/Owner of M3RealEstate